The income tax or national tax is one of the main ways in which governments raise funds to finance their projects and investments. In Japan, income tax is known as Shotokuzei and is applied to all people and companies that receive an income above a certain annual threshold. In this article, we'll explore what Shotokuzei is, who needs to declare it, what the tax rate is, and how to declare it.

Índice de Conteúdo

What is Shotokuzei?

Shotokuzei is a progressive income tax, which is applied to all individuals and companies that receive an income above a certain annual threshold.

This tax is one of the main sources of revenue for the Japanese government, being used to finance a series of public projects and programs, from infrastructure to social programs.

The word "shotokuzei" (所得税) is composed of two Japanese ideograms: "sho" (所), which means "possession" or "property", and "toku" (得), which means "obtaining" or "acquisition". and "zei" (税), which means "tax". Together, these ideograms form the term that means "income tax".

The origin of the term “shotokuzei” dates back to the beginning of the 20th century, when Japan began the implementation of a modern tax system, following the Western model.

In 1922, the country's first income tax law was enacted, establishing the foundations of the system that still exists today. It is a civic obligation and a means of financing government activities.

What is the rate of Shotokuzei?

The Shotokuzei rate is progressive and varies according to the taxpayer's annual income. The higher the income, the higher the rate applied. The rate table is updated annually by the Japanese government and can be found on its official website.

To illustrate, in 2022, the rates vary from 5% to 45%, depending on the income bracket. See below a table with the percentage of tax according to the income of each Japanese citizen.

| annual income range | Aliquot |

|---|---|

| Up to ¥1,950,000 | 5% |

| From ¥1,950,001 to ¥3,300,000 | 10% |

| From ¥3,300,001 to ¥6,950,000 | 20% |

| From ¥6,950,001 to ¥9,000,000 | 23% |

| From ¥9,000,001 to ¥18,000,000 | 33% |

| From ¥18,000,001 to ¥40,000,000 | 40% |

| Over ¥40,000,000 | 45% |

The rate is applied on the taxpayer's taxable net income, that is, the difference between taxable income and expenses during the fiscal year.

It is important to remember that these rates can change annually, we recommend checking the information on the official government website or with a professional.

What can be deducted from Japanese income tax?

There are several deductions allowed by law that can be used to reduce income tax in Japan. See some examples below:

- Personal deduction: An automatic, standard deduction of ¥480,000 is allowed for each taxpayer, which is reduced by ¥8,000 for every ¥1,000,000 of taxable income over ¥24,000,000. In addition, additional deductions are allowed for dependents, spouses and elderly parents living with the taxpayer.

- Deduction for medical expenses: You can deduct medical and dental expenses paid during the tax year, up to a limit of ¥100,000 per person. This includes expenses with medical appointments, treatments, exams, medications, among others.

- Education deduction: Deductions are allowed for education expenses, such as school fees, books, teaching materials, among others. The limit for this deduction is ¥120,000 per person.

- Deduction with donations: It is possible to deduct donations made to non-profit organizations, up to the limit of 40% from the taxable income of the taxpayer.

- Deduction with health insurance and social security contributions: Health insurance and social security contributions are also deductible, up to the maximum limit established by law.

- Private pension deduction: Contributions to private pension plans can also be deducted, provided they are within the limits established by law.

There are other specific deductions for certain types of income and expenses, such as rent, interest on real estate loans, housing expenses, among others.

The article is still halfway through, but we recommend also reading:

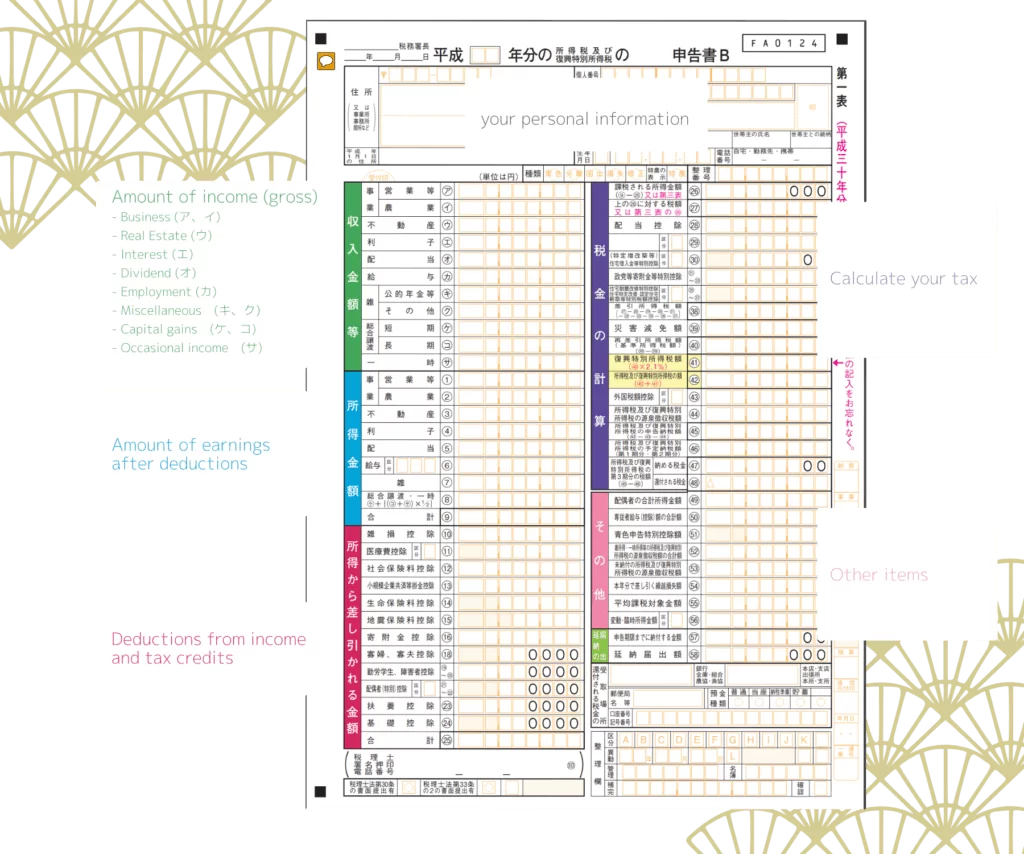

Japan income tax form

The income tax return form in Japan is called “Kakutei Shinkoku”. The form is made up of several sections where taxpayers need to provide detailed information about their income, expenses, deductions and other relevant items.

Below is a summary of the main sections of the Japanese income tax return form:

- Taxpayer Identification: This section includes personal taxpayer information, such as name, address, foreign registration number, and so on.

- Income: In this section, the taxpayer needs to report all types of income received during the tax year, including salaries, investment income, rents, pensions, among others.

- Expenses: In this section, the taxpayer can declare their deductible expenses, such as medical expenses, contributions to pension plans, charitable donations, among others.

- Personal deductions: The taxpayer can claim personal deductions for himself and his dependents, which are calculated based on income and number of dependents.

- Withholding tax: This section includes information about withholding tax on payments received during the tax year, such as wages and pensions.

- Calculation of tax due: Based on the information provided in the previous sections, the tax authority calculates the tax owed by the taxpayer.

- Tax payment: In this section, the taxpayer can indicate how he wants to pay the tax due, which can be done in installments or in cash.

What happens if you evade income tax in Japan?

Tax evasion is an illegal practice and can have even more serious consequences than simply not paying income tax in Japan. Tax evasion occurs when the taxpayer omits information or forges documents to avoid paying taxes.

If a taxpayer is caught evading taxes, he or she could face the following legal and financial consequences:

- Fines and interest: The taxpayer can be fined up to 50% of the tax due, plus daily interest on the amount due, until payment is made.

- Criminal process: Tax evasion is considered a criminal offense in Japan and can lead to criminal prosecution. The taxpayer may be summoned to appear in court and may be sentenced to imprisonment, additional fines and the costs of the lawsuit.

- Reputation loss: Tax evasion can have a negative impact on a taxpayer's reputation. If he is convicted of tax evasion, it could damage his professional and personal image, which is very important in Japan.

- Asset lock: The tax authority can block the taxpayer's assets, such as bank accounts and real estate, to recover the amount owed.

- Prohibition of carrying out commercial activities: In extreme cases, the tax authority may prohibit the taxpayer from engaging in commercial activities until the debt is paid.

- Prohibition of leaving the country: In extreme cases, the tax authority may prohibit the taxpayer from leaving the country until the due tax is paid.

- Pledge of goods: If the taxpayer does not make the payment even after the court decision, the tax authority may execute an order for attachment of assets. This means that the authority can seize the taxpayer's property, such as real estate, vehicles, investments or other assets, until the amount owed is recovered.